Shares and bonds performance

The Defensive, Moderate Balanced, Growth and High Growth funds in the Scheme have exposure to bonds and shares. In this unusual environment, both bonds and shares have not performed well.

For investors, the first six months of 2022 saw a powerful mix of difficult macro-economic and geopolitical conditions led by persistently high inflation, the tragic Russia-Ukraine war, supply chain disruptions, an accelerated pace of monetary policy tightening by major global central banks led by the US Fed and concerns over slowing economic growth. As a result, most investment assets have experienced large negative returns in 2022, also as known as ‘drawdown’. Major sharemarket indices have fallen by between 13% and 23% from their peaks in 2022. For example, the S&P 500 Index has seen its worst half-year drawdown since 1970.

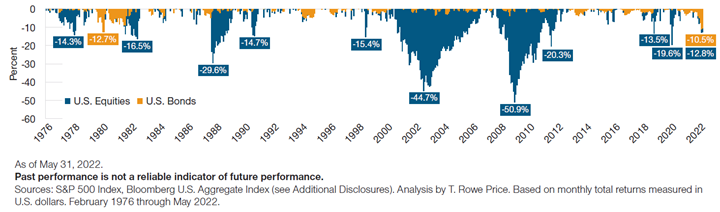

Historically, investors have generally been able to rely on their fixed interest holdings to cushion the blow if equity markets fell. However, these diversification benefits were notably absent year-to-date. As sharemarket returns plummeted, bonds experienced their worst drawdown in more than four decades. In fact, it was the first time since at least the mid‑1970s that share and fixed income markets both experienced a drawdown more severe than 10% at the same time. Referring to the below chart provided by one of our underlying global equities managers, T. Rowe Price, these losses were especially painful in inflation‑adjusted terms, as rapid price increases across many major economies led to the purchasing power of investments falling even more.

For further information on the correlation about shares and bonds, please read the article here .

20 July 2022