Analysis of Share-Bond returns correlation

Since the turn of the century, stocks and bonds have maintained a persistently negative correlation. According to an insight piece by one of our underlying global bond managers, Wellington Management, this sustained negative correlation is an anomaly, not the norm. According to Goldman Sachs calculations going back to 1900, a sustained negative correlation has occurred during only two market regimes prior to the late 1990s. Since the pandemic began, we’ve seen the rolling 12-month correlation between the US S&P 500 index and the US 10-year Treasury bond turn positive.

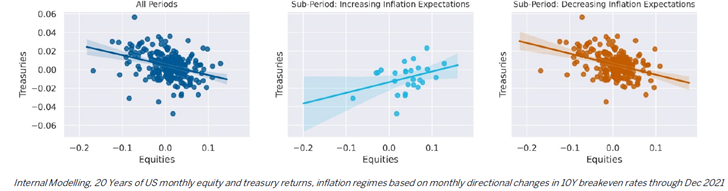

From Wellington Management’s analysis of equity-bond return relationships, exhibited in the chart below on the left, over 20 years of data through December 2021, shows this relationship is generally negative (as illustrated by the negative slope of the linear regression). However, this relationship has recently been heavily impacted by the transition risk of inflation. When modelling the inflation outlook change priced into the bonds market, the other two charts look at this relationship during the sub-periods when inflation expectations were either increasing (middle) or decreasing (right). As can be seen in the chart on the right, the negative relationship is only really apparent during periods of falling inflation expectations and as seen in the middle chart, the relationship is unlikely to be negative during periods when inflation expectations move higher. Wellington’s view is that the future of the stock/bond correlation hinges on whether inflation proves temporary or persistent. If supply is more constrained going forward, i.e. likely to push inflation expectation higher, equities and bonds returns could spend much of the time positively correlated.

20 July 2022