Changes to the international shares asset class

As Implementation Investment Manager, BT Funds Management (NZ) Limited (BTNZ) is responsible for the management of the investments comprising the different asset classes of the Westpac NZ Staff Superannuation Scheme. BTNZ’s approach is to delegate investment management functions to underlying investment managers to gain exposure to certain asset classes, including international shares.

Over the last year, BTNZ has undertaken a review of the underlying investment managers utilised within the international shares asset class. This review has resulted in several underlying investment manager changes.

The investment manager changes represent an evolution of BTNZ’s blended investment approach, whereby investment managers are selected from the full spectrum of investment strategies, while remaining mainly active overall.

Through these changes, the asset class now has a lower allocation to traditional active strategies, in favour of a higher allocation to systematic and index tracking strategies. Linked to this, the target out-performance, expected tracking error and fees for the strategy have all been reduced. We note the previous target alpha proved difficult to achieve, and we expect the portfolio to achieve the new target alpha with more consistency going forward, given the increased use of lower tracking error strategies, and the more tightly controlled sector and regional positions.

In addition, there is an increased investment in sustainable investment themes.

These changes have been implemented and below we provide further details:

Manager changes

Security selection for the international shares asset class was previously delegated to seven underlying investment managers. The review has resulted in three of these investment managers being removed (Ardevora Asset Management, MFS International Australia, and River & Mercantile Asset Management), and two new investment managers being appointed (Mirova and Schroder Investment Management).

Fee changes

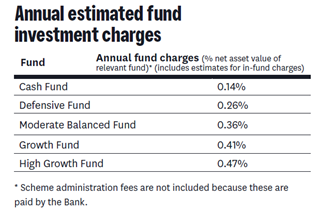

As a result of these underlying investment manager changes, the annual fund changes In-Tandem members pay have been reduced. These fees are charged as a percentage of your overall investment according to the investment option(s) you are invested in. Below are the new annual fund changes you will pay from 1st October 2023.

1. Mirova US LLC

Mirova, headquartered in Paris and founded in 2012, is an investment manager dedicated to sustainable investing through a conviction-driven approach. The firm’s goal is to combine value creation over the long term with sustainable development. Mirova aims to do this by being an active, committed, and leading player in sustainable finance while offering its clients investment solutions seeking financial performance with both environmental and social impact. The Mirova global equity strategy uses a thematic approach focused on integrating sustainability to build a high conviction portfolio of companies.

2. Schroder Investment Management Australia Limited

Schroders is a global investment manager, founded in 1804 and headquartered in London with offices spanning 38 locations worldwide. Schroders believes it has a competitive advantage from its in-house global research which is the foundation for its investment process. Inherent in its approach to investment management is a structured, disciplined, and repeatable investment process, a clearly defined investment style and a team-based approach. Schroders’ quantitative equity strategies seek to invest in undervalued, quality companies.

9 November 2023