Negative interest rates

Interest rates in New Zealand and around the world are exceptionally low, and have just recently gone lower. They are the lowest they have ever been in New Zealand. This low interest rate environment we are in is positive for borrowers, like those with mortgages, however not so great for savers or investors. The Reserve Bank of New Zealand (RBNZ) have a mandate of controlling inflation and supporting full employment. One of the tools they have to do this is setting the Official Cash Rate (OCR), which influences short-term interest rates such as the 90-day bank bill rate and cash investments, as well as long-term interest rates and the foreign exchange rate.

When things aren’t going well, the RBNZ will cut the OCR, which will make it easier for people and companies to borrow. This may mean people have more disposable income to spend, and companies are more likely to hire people, which is a positive cycle to help the overall economy function. The opposite happens when things are going too fast and inflation might be a concern, the RBNZ will increase the OCR to slow things down to a manageable pace.

On 16 March 2020, in response to the rapidly deteriorating economic situation relating to COVID-19, the RBNZ cut the OCR to 0.25% and expects to keep it at this level for at least the next 12 months.

While this isn’t a cure for COVID-19, it does offer borrowers like companies and those with mortgages a bit of respite. The RBNZ taking a number of measures to ensure that the banking system continues to function normally.

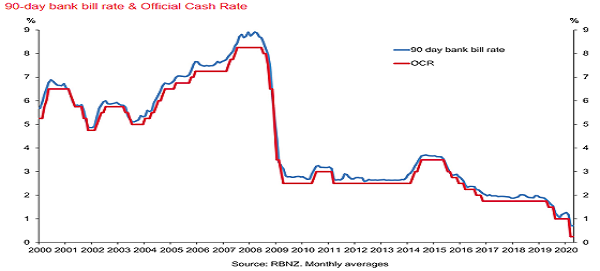

To put this OCR cut in context, the graph below shows the OCR in red and the 90 day bank bill rate in blue. The 90 day bank bill rate gives a guide on the level of return you might expect from cash investments going forward. As you can see, it is the lowest it has been in the past 20 years, in fact it is the lowest it has ever been.

The RBNZ has signalled that negative interest rates are a possibility and for those that are investing for the immediate future, cash may still be the best option. While it will not generate much of a return, it will still provide the stability and lower risk profile than the other Funds. However once tax and fees are taken into account, the return you get in your account (the Cash Fund mainly) may be close to zero or even slightly negative.

It is key for members to ask themselves why they are investing before considering any changes to their investment strategy. If the main purpose is for capital protection (protecting the real value of money from inflation), then members need to accept that capital protection is not guaranteed and returns may be close to zero or a slight negative. If the purpose is to seek high returns, then a higher degree of risk (a more aggressive investment option such as the Balanced or Growth Funds) will need to be taken given the current market environment. Seek financial advice before you consider making any changes to your investment strategy – you can speak to a financial adviser here.

When things aren’t going well, the RBNZ will cut the OCR, which will make it easier for people and companies to borrow. This may mean people have more disposable income to spend, and companies are more likely to hire people, which is a positive cycle to help the overall economy function. The opposite happens when things are going too fast and inflation might be a concern, the RBNZ will increase the OCR to slow things down to a manageable pace.

On 16 March 2020, in response to the rapidly deteriorating economic situation relating to COVID-19, the RBNZ cut the OCR to 0.25% and expects to keep it at this level for at least the next 12 months.

While this isn’t a cure for COVID-19, it does offer borrowers like companies and those with mortgages a bit of respite. The RBNZ taking a number of measures to ensure that the banking system continues to function normally.

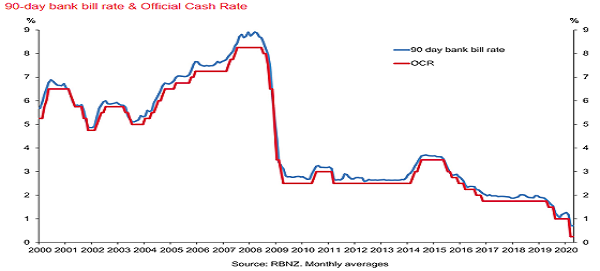

To put this OCR cut in context, the graph below shows the OCR in red and the 90 day bank bill rate in blue. The 90 day bank bill rate gives a guide on the level of return you might expect from cash investments going forward. As you can see, it is the lowest it has been in the past 20 years, in fact it is the lowest it has ever been.

The RBNZ has signalled that negative interest rates are a possibility and for those that are investing for the immediate future, cash may still be the best option. While it will not generate much of a return, it will still provide the stability and lower risk profile than the other Funds. However once tax and fees are taken into account, the return you get in your account (the Cash Fund mainly) may be close to zero or even slightly negative.

It is key for members to ask themselves why they are investing before considering any changes to their investment strategy. If the main purpose is for capital protection (protecting the real value of money from inflation), then members need to accept that capital protection is not guaranteed and returns may be close to zero or a slight negative. If the purpose is to seek high returns, then a higher degree of risk (a more aggressive investment option such as the Balanced or Growth Funds) will need to be taken given the current market environment. Seek financial advice before you consider making any changes to your investment strategy – you can speak to a financial adviser here.

This information has been prepared by Mercer (N.Z.) Limited for general information only. The information does not take into account your personal objectives, financial situation or needs.This information has been prepared by Mercer (N.Z.) Limited for general information only. The information does not take into account your personal objectives, financial situation or needs.

18 Nov 2020