Market update - quarter ended 31 December 2022

While the volatility remained elevated in financial markets over the December quarter, bonds and equities delivered positive returns, recouping some of the losses experienced earlier in the year. The key theme for the December quarter was an increasing sense that central banks’ ongoing monetary policy tightening will lead to a global economic slowdown in 2023 and an emerging belief that inflation rates may have peaked. These fuelled expectations of a monetary policy “pivot” by the US Federal Reserve despite the Fed’s best efforts to dampen this optimism. The positive sentiment continued in January 2023 as markets had a very strong start to the year. Both equities and bonds had a good rally with the exception of energy and commodity prices which saw a decline. Additionally, prospects of a full re-opening in China, the decline in energy prices in Europe and encouraging data on inflation were key market drivers. Context provided below:

Inflation and Central banks

While market expectations were for consumer price inflation rates (CPI) to peak and then start to fall back down towards central banks’ long-term target of 2%, in reality, core inflation rates (excluding food and energy) have instead plateaued around their high level across regions. Central banks have acknowledged that while a restrictive monetary policy is required to combat inflation, such a policy could trigger a recession. Developed markets central banks such as the US Federal Reserve (US Fed), the European Central Bank (ECB), the Bank of England (BoE) and the Reserve Bank of New Zealand (RBNZ) raised their target interest rates by 1.25% over the quarter. The Reserve Bank of Australia (RBA) reduced its pace of rate hikes during the quarter while a notable outlier was the Bank of Japan (BoJ) which maintained its accommodative monetary policy while adjusting its domestic bond yield curve control policy by slightly widening the trading range of Japan’s 10-year bond yield. Although such a change had always been recognised by investors as a logical first step towards policy normalisation, the timing of the decision was a complete surprise. This gave investors a glimpse of what to expect when the world’s boldest experiment with ultra-loose monetary policy comes to an end. While headline inflation is likely to have peaked, we expect volatility to persist.

Economic activity slowdown and corporate earnings

As major central banks kept hiking rates, surveys of manufacturing and service industries (PMI and PSI) around the world have shown some signs of fatigue, reflecting a slowdown in economic activity despite labour markets remaining robust. While supply chain disruptions have improved, bringing down the cost of transporting goods, the optimism arising from this is being tempered by headwinds from sharp interest rate increases, geopolitical tensions, and the trend toward deglobalisation. From a corporate earnings perspective, the US S&P 500 Index constituent reporting season for Q3 2022 indicated some deceleration in earnings and revenue growth. However companies continued to report revenues and profits higher than consensus estimates, which helped global equity markets recoup some losses experienced in the previous quarter.

China lifted its zero-COVID policy restrictions

Until early December, China maintained its restrictive zero-Covid policy stance, suppressing a number of demonstrations against this stance which erupted across the country. However the government then made an abrupt U-turn, abandoning many of its restrictions, apparently in response to protests and the economic impact of restrictions. The number of Covid cases soon began to rise quickly. China also began easing its restrictions on the property sector, which is another signal that President Xi Jinping is now turning his attention on reviving the economy.

Geopolitics

UK political drama dominated financial markets in October, with saw British Prime Minister Liz Truss resigning after just 44 days in office over a dramatic U-turn on her tax cut and spending increases policies. The Russia-Ukraine conflict crossed ten months in December and showed no signs of easing and has sadly so far caused tens of thousands of casualties and forced millions from their homes. On US-China relationships, Joe Biden and Xi Jinping agreed to a series of goodwill gestures intended to improve ties between their countries. In the US, while losing control of Congress to the Republicans, Democrats defied political forecasts and historical trends to keep control of the Senate in a win for President Joe Biden as voters rejected a handful of candidates backed by former President Donald Trump.

Climate

On the climate front, this year’s United Nations Climate Change Conference COP27 was held in November in Sharm El-Sheikh, Egypt and delivered an agreement on a “Loss and Damage” fund for countries vulnerable to the impacts from climate change. Whilst only small amounts of funding have been committed by developed countries to the fund to date, the agreement has been considered a breakthrough as this aspect had not been successfully addressed since 1992, when vulnerable countries first started calling for compensation. However, the conference saw no further progress on revisiting and strengthening the 1.5 degree C commitments reached last year at COP26 in Glasgow.

Looking forward, the economic outlook especially in the US does look challenging. Leading indicators are showing deceleration in the economy in the latter half of this year with interest rates in restrictive territory and lending standards having tightened considerably. On the plus side, the labour market is still looking healthy which is good news for consumption. After doing a lot of the heavy lifting by hiking interest rates aggressively last year, central banks are expected to proceed more cautiously in 2023, which in turn is likely to dampen interest rate volatility. On the flip side, as Chinese demand picks up on the back of reopening, any renewed upward pressure on energy prices may in turn push inflation higher and make the work of central banks more difficult. The macro environment is creating opportunities for active managers to buy high quality assets. Ensuring your portfolio is well diversified remains essential.

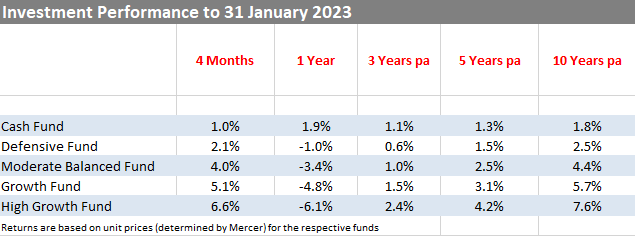

Investment Performance as at 31 January 2023, after fees and tax:

Source: BT Funds Management

9 March 2023