Buying your first home

How much do you really have for a first home deposit? When you combine your In-Tandem savings, your KiwiSaver savings (if applicable), HomeStart grant and other savings you have, you may be surprised how quickly these add up.

Housing affordability often features in the news headlines, and for good reasons. Over the past decade, house prices have risen considerably, making it harder for Kiwis to get their foot on the property ladder.

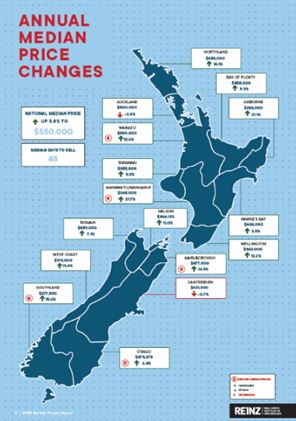

In the last five years alone, New Zealand’s property market value rose 8.5% and in January 2019 the median house price was $550,000. Median prices for the country excluding Auckland reduced to $473,000. Rising prices is good news for existing home owners, however they make it harder for first home buyers to save the 10-20% mortgage deposit required by most banks.

How much do you really have?

- In-Tandem: After you have been a member of In-Tandem for three or more consecutive years you may make a withdrawal from your In-Tandem savings. You have the option to either withdraw a partial amount, or all available funds from your Scheme account. You can find more information about this in the ‘Buying a first home with KiwiSaver or In-Tandem FAQs’ document, the application form, or the Product Disclosure Statement.

- HomeStart grant: If you have belonged and contributed to an exempt employer scheme (this includes In-Tandem) or a KiwiSaver scheme, for at least three years, it’s likely you will be eligible for a HomeStart grant. The grants are administered by Housing New Zealand. If purchasing an existing home, the grant is between $3,000 and $5,000 per person based on $1,000 for each completed year of membership (you must have contributed during these years). If you plan on building a new home or to buy land to build a new home on, the grant is in effect doubled to $2,000 per year of membership per person, up to a maximum of $10,000. This means that a couple buying a home together could potentially have $10,000 available for an existing home, and $20,000 for purchasing a new home or undertaking a new build.

- Other savings: Withdrawing your retirement savings can take some time to process, so having additional savings available can be helpful to put towards the deposit listed on the sales and purchase agreement. The deposit can often be due upon the agreement going unconditional, so cash in the bank allows you to make the payment on time.

Combined, these savings can quickly add up. Here’s an example of how this could look:

Meet Kyle & Sam Kyle is 30 years old and Sam is 25, they live in theHutt Valey. Between them they earn $100,000 a year (before tax). They are looking to buy their first home for $500,000 in Lower Hutt. After five years of Scheme membership, they have saved $41,000. They also have $10,000 in KiwiSaver and $14,000 in their joint bank account. Additionally, because they have been members of a retirement savings scheme for over five years, they are both entitled to a $5,000 HomeStart grant (totalling $10,000). Kyle and Sam can now access $75,000, which may be enough for a deposit. |

HOW DOES IT ALL WORK? $41,000 in Scheme savings + $10,000 in KiwiSaver savings + $14,000 in other savings + $10,000 as a HomeStart grant1 from Housing New Zealand = $75,000 home deposit |

1HomeStart grant is administered by Housing New Zealand. Rules apply and more information can be found at hnzc.co.nz.

28 March 2019